|

|

|

|

|

|

|

BMW Garage | BMW Meets | Register | Today's Posts | Search |

|

|

BMW 3-Series (E90 E92) Forum

>

Stock market tips and experiences

|

|

| 09-13-2023, 08:53 PM | #8031 | |

|

Private First Class

1322

Rep 135

Posts |

Quote:

Homebuilders keep building, of course, because that's what they do as long as they can access capital. But they are juicing the market by buying down mortgages, eating the costs of upgrades, etc., which is gonna squeeze their margins. They always overbuild themselves into a hole in the ground and will hit the wall pretty soon, I think. But the real key is, of course, jobs. As long as people have 'em they'll stay put. When they start losing them, and are forced to move, that's when we'll see inventories rise. If enough jobs are lost maybe prices will fall, or at least stop going up. And not just for houses, but for other goods and services. The question is, will enough people lose their jobs that we'll have a proper recession so that we can get back to a growing economy, or are we going to bump along the bottom of a "soft landing" with minimal growth and persistently high inflation? Personally, I'm not a fan of stagflation (look at Europe) and would prefer the Fed have the balls to keep interest rates up long enough to break the back of the jobs market. Yes, that'll mean a lot of pain for a (relatively) small number of people, but it's infinitely preferable than stagflation, which hurts nearly everyone. |

|

|

Appreciate

0

|

| 09-13-2023, 09:17 PM | #8032 | |

|

Private First Class

1322

Rep 135

Posts |

Quote:

The government here (which "the people" - not me - voted for) is going to fix the lack of housing problem... by reducing the population of the state. People are fleeing in droves. The Golden State has become the Golden-Shower State, IMHO. Since I moved here in 1980 is just one stupid thing after the other and there are few signs of things changing. PG&E is going to start charging you for electricity not on the amount of electricity you use, but on your income. Our $21,000 bottle-of-wine-drinking governor is heading to China to talk climate-change instead of trying to actually do something about the tens of thousands of mentally ill & drug addicted people running amok in our cities that his policies have created. Wait until that knucklehead is president. Y'all are gonna get a taste of this lunacy. I could go on, but you get the picture. I'm lucky to live in a lovely little corner of the coast that has largely been spared to date, but it's changing and now even here we're seeing things we've never seen (or wanted to see) before. My wife grew up here and it's going to be tough to get her to go, but eventually we likely will. Otherwise, I'm afraid the state's going to milk us dry while our quality of life just keeps slipping away. Not sure I can do well enough in the market to stay ahead of it. |

|

|

Appreciate

1

TboneS541198.50 |

| 09-15-2023, 09:03 AM | #8033 | |

|

Major General

10907

Rep 9,072

Posts |

Quote:

And yes, I agree... there would be a ton of pain but this soft landing bullshit is just prolonging the pain and creating further problems. Jack the rate up to 10% and stop with the liquidity bullshit that the fed has been going back and forth on... QE came right back as soon as those banks started to fail. There are simply too many problems right now out there that NEED to be rightsized that sadly only killing demand and a recession can fix.

__________________

2 x N54 -> 1 x N55 -> 1 x S55-> 1 x B58

|

|

|

Appreciate

0

|

| 09-15-2023, 11:31 AM | #8034 |

|

Colonel

8123

Rep 2,512

Posts

Drives: 9Y0 Cayenne S

Join Date: Mar 2019

Location: Einbahnstraße

|

Setting aside interest rates and liquidity, what is the supply of dwellings relative to total population?

In the end, people need a place to sleep every night, agree? What is the aggregate (nationwide) situation in this regard? |

|

Appreciate

0

|

| 09-15-2023, 11:58 AM | #8035 |

|

YNWA

1199

Rep 908

Posts |

Judging by the amount of cars parked on the streets, everyone's living in one house (3+ generations).

__________________

/// 2004 Silvergrey M3 · Coupe · 6MT · Slicktop · zero options

/// 2011 Jerez/Bamboo E90 M3 · DCT · Slicktop · IG: @na.s54 |

|

Appreciate

0

|

| 09-15-2023, 12:02 PM | #8036 |

|

Major

874

Rep 1,122

Posts

Drives: Lots of BMWs

Join Date: Aug 2013

Location: RI/MA

iTrader: (0)

Garage List 2018 M4 Vert [0.00]

2006 Z4M Roadster [0.00] 1995 540i [0.00] 2008 BMW M5 [0.00] 2019 i3 Rex [0.00] 2021 X7 40i MSport [0.00] |

There was a laughable story I read this week that said housing prices were being kept high for two reasons; 1 from from separating boomers, empty nesters who now realize they don't want to be together anymore and now 1 of them needs a new place to live, 2 from boomers/gen x who have adult children living with them and they want them out.

__________________

2008 M5 6spd, 1995 540i 6spd

2018 M4 Vert Comp, 2019 i3 120ah REX 2021 X7 40i MSport, 2006 Z4M 6spd |

|

Appreciate

0

|

| 09-15-2023, 12:16 PM | #8037 | |

|

Private First Class

1322

Rep 135

Posts |

Quote:

I wonder, though, how relevant the "nationwide" part of your question is chassis. Isn't housing a uniquely local issue? What, for instance, does it matter to that grad moving to Scranton what the the price of an apartment in Miami is? And when mass migration to, say NYC, occurs local leaders immediately start talking about moving them to somewhere where there's housing available, like upstate NY. In other words, another locale. Here in CA it's become hyper-local, with neighborhoods in small cities like Santa Cruz fighthing each other over development; this being CA, fighting to keep it out of their own, of course. And, personally, I don't give a rat's ass what the cost of a house in upstate NY is, cuz aint' a snowball's chance in hell I'm moving there.  |

|

|

Appreciate

0

|

| 09-15-2023, 06:07 PM | #8038 | |

|

Brigadier General

4831

Rep 3,611

Posts |

Quote:

From this week's issue of The Economist:

__________________

2017 M240i: 25.9K, 28.9 mpg, MT, Sunroof Delete, 3,432#, EB, Leather, Driving Assistance Package, Heated Front Seats | Sold: E12 530i, E24 M635CSi, E39 520i, E30 325is, E36 M3 (2)

TC Kline Coilovers; H&R Front Bar; Wavetrac; Al Subframe Bushings; 18X9/9½ ARC-8s; 255/35-18 PS4S (4); Dinan Elite V2 & CAI; MPerf Orange BBK; Schroth Quick Fit Pro; Full PPF |

|

|

Appreciate

1

chassis8123.00 |

| 09-15-2023, 10:01 PM | #8039 | |

|

Colonel

8123

Rep 2,512

Posts

Drives: 9Y0 Cayenne S

Join Date: Mar 2019

Location: Einbahnstraße

|

Quote:

The question arises as to what is the optimal housing stock to population ratio. Last edited by chassis; 09-15-2023 at 10:14 PM.. |

|

|

Appreciate

0

|

| 09-16-2023, 09:19 AM | #8040 |

|

Private First Class

322

Rep 151

Posts |

Housing will get sorted, but it's going to take time. During the financial crisis the top came in 2007, the bottom didn't hit until early 2012. 5 years.

Current market is not the same dynamic, but my point is that these things take time to play out. Lots of variables in the mix: the short term rental market is starting to unwind, especially in popular areas like Florida, Sierras, Montanta. This will add inventory, especially if people become distressed. Boomer retirements/downsizing/dying will free up inventory. That ~10% of the market that *has* to sell (death/divorce/etc.) will have to adjust to what the market will bear. This will put pressure on others. In terms of inventory: there's plenty of it. The problem is affordability, and the fact that investors (including moms and pops) bought up tons of inventory to then rent out. The longer people look at housing as an investment opportunity versus a place to live, the longer it will take for the bubble to deflate. This isn't that dissimilar to higher education or to the previous financial bust in '08: you've got herd mentality that has driven money into an asset class, and outside of a major crisis, this time wont be a big bbang, but a slow deflation. We're seeing similar in higher education, as enrollment rates are dropping, schools are consolidating/closing, and students are electing to attend more affordable options. Took 80 years to build the educational complex, it ain't collapsing overnight. Housing will be similar - the unwind will take time. |

|

Appreciate

0

|

| 09-16-2023, 12:46 PM | #8041 | |

|

Colonel

8123

Rep 2,512

Posts

Drives: 9Y0 Cayenne S

Join Date: Mar 2019

Location: Einbahnstraße

|

Quote:

Excellent post. |

|

|

Appreciate

0

|

| 09-16-2023, 01:43 PM | #8042 |

|

Brigadier General

4831

Rep 3,611

Posts |

Perhaps it's one where home prices and rents are in a range that Americans in a given region feel they can afford.

__________________

2017 M240i: 25.9K, 28.9 mpg, MT, Sunroof Delete, 3,432#, EB, Leather, Driving Assistance Package, Heated Front Seats | Sold: E12 530i, E24 M635CSi, E39 520i, E30 325is, E36 M3 (2)

TC Kline Coilovers; H&R Front Bar; Wavetrac; Al Subframe Bushings; 18X9/9½ ARC-8s; 255/35-18 PS4S (4); Dinan Elite V2 & CAI; MPerf Orange BBK; Schroth Quick Fit Pro; Full PPF |

|

Appreciate

0

|

| 09-16-2023, 05:57 PM | #8043 | |

|

Private First Class

322

Rep 151

Posts |

Quote:

Truth is, you want affordable housing? There's plenty in Tulsa, OK. Detroit. Cleveland. Indiana. Arkansas. Problem is: nobody wants to go there. So, in many ways, this is the same story told decade after decade. |

|

|

Appreciate

0

|

| 09-16-2023, 06:13 PM | #8044 |

|

Colonel

8123

Rep 2,512

Posts

Drives: 9Y0 Cayenne S

Join Date: Mar 2019

Location: Einbahnstraße

|

|

|

Appreciate

0

|

| 09-16-2023, 09:11 PM | #8045 |

|

Brigadier General

4831

Rep 3,611

Posts |

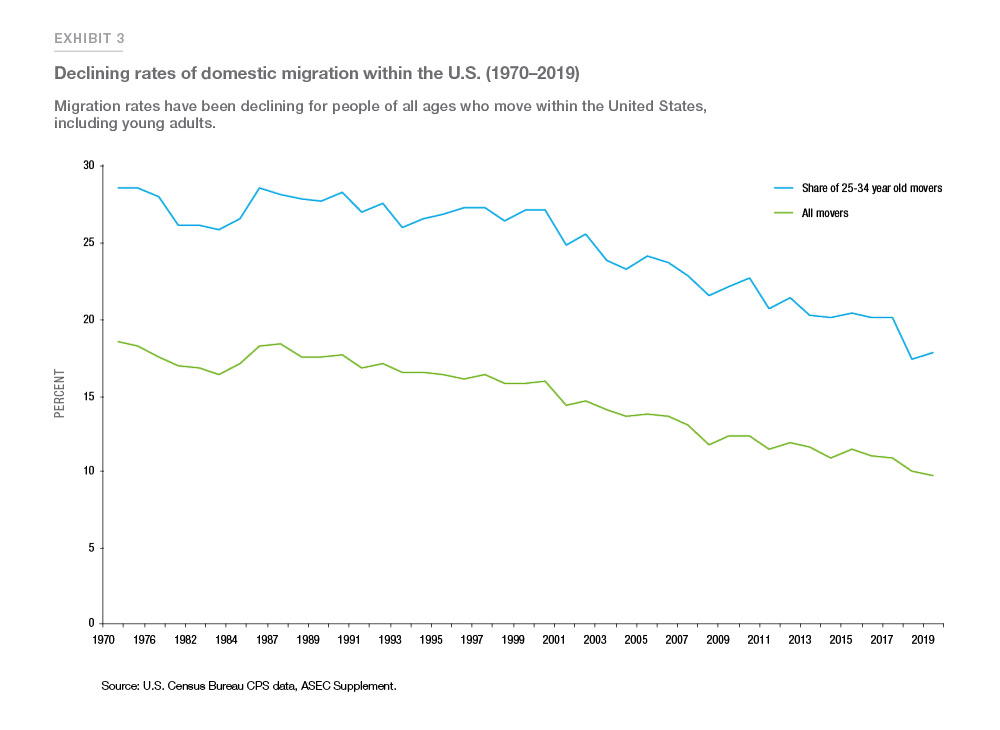

It's been reported regularly for some time now that Americans' rate of moving has been trending down. The US Census Bureau has the raw data in tabular form; except in bits and pieces, however, it can take some time to find a useful chart or graph. There's one below.

I did come across one interesting tidbit while searching: renters move much more frequently than do homeowners. No surprise there, I suppose. Declining Rates of Domestic Migration within the U.S. (1970-2019) Source: https://www.thepolicycircle.org/mini...etween-states/

__________________

2017 M240i: 25.9K, 28.9 mpg, MT, Sunroof Delete, 3,432#, EB, Leather, Driving Assistance Package, Heated Front Seats | Sold: E12 530i, E24 M635CSi, E39 520i, E30 325is, E36 M3 (2)

TC Kline Coilovers; H&R Front Bar; Wavetrac; Al Subframe Bushings; 18X9/9½ ARC-8s; 255/35-18 PS4S (4); Dinan Elite V2 & CAI; MPerf Orange BBK; Schroth Quick Fit Pro; Full PPF |

|

Appreciate

1

chassis8123.00 |

| 09-16-2023, 10:08 PM | #8046 | |

|

Colonel

8123

Rep 2,512

Posts

Drives: 9Y0 Cayenne S

Join Date: Mar 2019

Location: Einbahnstraße

|

Quote:

What is the problem you referred to a few posts ago? Domestic migration is a relative concept, therefore problematic. Domestic migration can refer to migration between regions, states, counties, townships, etc. You mentioned states and cities a while back so are you talking about a state-based definition, or something else? |

|

|

Appreciate

0

|

| 09-17-2023, 08:32 AM | #8047 | |

|

Major General

10907

Rep 9,072

Posts |

Quote:

__________________

2 x N54 -> 1 x N55 -> 1 x S55-> 1 x B58

|

|

|

Appreciate

0

|

| 09-17-2023, 08:35 AM | #8048 | |

|

Major General

10907

Rep 9,072

Posts |

Quote:

__________________

2 x N54 -> 1 x N55 -> 1 x S55-> 1 x B58

|

|

|

Appreciate

0

|

| 09-17-2023, 09:44 AM | #8049 | |

|

Private First Class

322

Rep 151

Posts |

Quote:

I'm on the side of: housing prices will decline before interest rates are cut significantly. We're on the other side of the interest rate cycle for the foreseeable future - rates will stay elevated. Energy prices, labor shortages, reshoring/nearshoring, societal change in attitudes toward work, lowered birth rates, climate initiatives, government debt interest...all inflationary. Unlike the last 40 years' deflationary opportunities (automation, offshoring, cheap energy), we're now scaling a wall of inflationary pressures. We've got 20 years of financial decisions based upon artificially low (or zero) interest rates. It's going to take time for this to correct, and all that assumes no major black swan events occur. |

|

|

Appreciate

1

ASAP10907.00 |

| 09-17-2023, 09:48 AM | #8050 | |

|

Private First Class

322

Rep 151

Posts |

Quote:

If anything, migration patterns during the pandemic reinforce this: the mass migrations of people out of places like New York, Illinois, California into places like Idaho, Texas, Montana, Carolinas and Florida were for quality of life issues. |

|

|

Appreciate

0

|

| 09-17-2023, 10:18 AM | #8051 | |

|

Major General

10907

Rep 9,072

Posts |

Quote:

__________________

2 x N54 -> 1 x N55 -> 1 x S55-> 1 x B58

|

|

|

Appreciate

0

|

|

| Bookmarks |

|

|