|

|

|

|

|

|

|

BMW Garage | BMW Meets | Register | Today's Posts | Search |

|

|

BMW 3-Series (E90 E92) Forum

>

Gold

|

|

| 10-29-2011, 02:52 AM | #2 | |

|

Lieutenant

87

Rep 590

Posts |

Quote:

You should be selling gold not buying it. When you see commercials on TV about gold that means you are to late. Also, remember buying physical gold gives you no liquidity...If you wanna sell it you will be at a pawn shop getting 1/2 of what you paid for it. Good luck with whatever you decide.

__________________

2021 Mercedes G550

2015 X5M 2020 Supra-JB4, DP 2008 M5 with muffler delete-sold 2007 650i-sold 2008 335i-JB4, DP, Meth-sold |

|

|

Appreciate

0

|

| 10-29-2011, 05:45 AM | #3 | |

|

Captain

286

Rep 884

Posts |

I only profit from buying... profiting from selling is illegal here

__________________

Quote:

|

|

|

Appreciate

0

|

| 10-29-2011, 09:39 AM | #4 | |

|

First Lieutenant

52

Rep 337

Posts |

Quote:

|

|

|

Appreciate

0

|

| 10-29-2011, 11:47 AM | #5 | |

|

Private First Class

11

Rep 151

Posts |

Quote:

Spoken like someone who has never bought physical. To the OP, I have limited physical gold (a little over 2 oz's), but I have quite a bit of silver. You need to find your local PM dealers in your area if you want to physically handle the gold before you buy it. Online sources include APMEX, Tulving, and Kitco. I prefer Tulving as they give the best price over spot, APMEX runs some good deals every once in a while. |

|

|

Appreciate

0

|

| 10-29-2011, 11:53 AM | #6 | |

|

Captain

126

Rep 876

Posts |

Wow, making a statement like this is so irresponsible...you do know gold has risen on avg. 15% per yr for probably decade now right?...what has the Dow and SPX done over the past decade?..it has gone nowhere.

When you say you sell gold at pawnshop for 1/2 of what you paid or what its worth is a blatant lie...any reputable gold dealer pays you spot prices or even more than spot!..it has great liquidity...I sold 10 pieces few months ago and guy handed me 17K in cash...thats liquidity...he paid me 20.00 over spot prices!.....Blanchards Gold(d internet search) will pay at least spot...this is a good place t order from btw. If you buy the ETF GLD sure you can own this stock but if everyone heads for the exit at once these types of etf's will collapse cause they have way more stock out there than the physical gold they are holding in their vaults...so in some ways its a scam. If you invest in gold, buying physical gold is best...now timing is difficult because gold has been on a good run for years now but in no way is it at the end of a bubble now...that will come later...I have seen tech bubbles and real estate bubbles and we arent at the end of the gold bubble yet....plot out 5 yr chart on GLD and when price gets near the 200 day moving avg that is time to buy and if it doesnt hold this level then something is wrong and you sell for small loss...thats what I would do. Gold relates to the value of the dollar...this is key...dont look at anything else,..it has little to do with actual demand which is counter intuitive...cause gold is REAL money and not just a commodity..when the value of the US dollar goes up gold will go down and vice versa. So the question is this, will the Federal Reserve print more money when the next financial crisis hits the US like europe is facing now?...if the answer is yes, then gold will take off...if you think the uS govt will decrease debt and stay within the budget, then the value of the dollar will rise and gold will go down. So the price of gold, or even gas and silver will depend on what the Federal Reserve and the US govt will do with respect to money supply(ie-money printing). Will the US print money like they have for every recession and crisis...if yes, then gold goes up and bubble forms....there you have it. Quote:

|

|

|

Appreciate

0

|

| 10-29-2011, 03:33 PM | #7 |

|

Lieutenant

87

Rep 590

Posts |

^^^

Exactly my point......number 1 rule with investing buy low, sell high. So, gold is high hmmm...agreed good to diversify, but now is not the time to buy gold. In regards to my luquidity statement many of my clients ask about buying Gold because they think the US and dollar are going away (mainly in March of 09'). So...if that extreme would happen running around with chunks of gold would do you no good...u would need guns, ammo, water, etc...  Why do you think there are so many gold ads right now. You never saw them advertising back when gold was a third the price it is today?? But that would've been the time to buy!! March of 09 you didn't see ads for buying stocks BUT had you bought stocks, even nondividend-paying stocks, you would've been close doubling your investment today. Feel free to attack me with lines like "spoken from someone who has never bought any...". I manage others money for a living, I was just giving advice to the OP. Of course, he will invest how he likes but that's the point of the forum...asking a question and getting advice from others. I guess that's why some people get paid to give others financial advice...

__________________

2021 Mercedes G550

2015 X5M 2020 Supra-JB4, DP 2008 M5 with muffler delete-sold 2007 650i-sold 2008 335i-JB4, DP, Meth-sold |

|

Appreciate

0

|

| 10-29-2011, 04:00 PM | #8 |

|

Lieutenant

87

Rep 590

Posts |

Mact3333

Gold is driven by supply in demand, if everyone sells there gold ETF, your gold is worth less...and you have to find time to take it somewhere to sell it. "irresponsible".....When I get in the office on Monday I will take a look at my Gold info and post exact numbers...but it is close to this....if you bought gold in 1980 it was 800 an ounce or so, now it's at 1750 or so....if you are happy doubling your money every 30 years good for you. "Rule of 72" divide your interest rate by 72 and that's how long it takes to double your money..... The Dow was at 800 in 1980, now its at over 12k.... You do the math and tell me how I am irresponsible?? I recommend 5-10% tops of portfolio in precious metals, but now is not the time to buy!

__________________

2021 Mercedes G550

2015 X5M 2020 Supra-JB4, DP 2008 M5 with muffler delete-sold 2007 650i-sold 2008 335i-JB4, DP, Meth-sold |

|

Appreciate

0

|

| 10-29-2011, 05:20 PM | #9 |

|

Banned

56

Rep 1,739

Posts

Drives: 2008 Z4MC

Join Date: Aug 2010

Location: Seattle, Vancouver

|

I'm glad ur not in charge of my $$$

|

|

Appreciate

0

|

| 10-29-2011, 06:58 PM | #11 |

|

Lieutenant

87

Rep 590

Posts |

AMEN!!

__________________

2021 Mercedes G550

2015 X5M 2020 Supra-JB4, DP 2008 M5 with muffler delete-sold 2007 650i-sold 2008 335i-JB4, DP, Meth-sold |

|

Appreciate

0

|

| 10-29-2011, 07:00 PM | #12 |

|

Lieutenant

87

Rep 590

Posts |

Well, I guess your advisor will make you feel good, when u buy high...

I am glad yur not my client...

__________________

2021 Mercedes G550

2015 X5M 2020 Supra-JB4, DP 2008 M5 with muffler delete-sold 2007 650i-sold 2008 335i-JB4, DP, Meth-sold |

|

Appreciate

0

|

| 10-29-2011, 07:30 PM | #13 |

|

Banned

56

Rep 1,739

Posts

Drives: 2008 Z4MC

Join Date: Aug 2010

Location: Seattle, Vancouver

|

Listening to you, I wouldn't have bought on the dip two weeks ago and come out on top. Ur generic advice based on tv ads isn't what anyone is talking about.

|

|

Appreciate

0

|

| 10-29-2011, 10:05 PM | #15 | |

|

Lieutenant

87

Rep 590

Posts |

Quote:

I have provided ways for the OP to own gold, given advice on recommended % in portfolio, and also advised now is not a good time to buy....not sure what more detail you are seeking (even though your not OP) Not sure why you are getting all out of shape, I said to own precious metals?!? Maybe you overreacted because you just bought gold and realized the mistake you made?? OP, hope this gold debate has helped you out. As always do your own research, talk to several professionals and try toget some unbiased advise. Good luck!

__________________

2021 Mercedes G550

2015 X5M 2020 Supra-JB4, DP 2008 M5 with muffler delete-sold 2007 650i-sold 2008 335i-JB4, DP, Meth-sold |

|

|

Appreciate

0

|

| 10-29-2011, 10:10 PM | #16 |

|

Brigadier General

381

Rep 4,166

Posts |

BRICKS.

__________________

Audi R8 v10 Ford Raptor m3e46freak@yahoo.comfor all euro parts!! ebay/craigslist verified/ m3post/e46fanantics/m3forum/zpost/bimmerforum |

|

Appreciate

0

|

| 10-30-2011, 11:57 AM | #17 |

|

Major General

3659

Rep 9,783

Posts |

I heard on TV the other day that some hedge fund guy made a boat load of money buying investing in gold. He also predicted that gold will hit $2500 or so an oz?? (i forgot the unit of measurement) in the next year or two.

So that got me thinking: why not buy it now and sell it back when it goes up that high? Then I got to thinking again and realized that it's just some guy's prediction. If he's right it would be great. If he's wrong, however, and prices go down I'm gonna be fucked. Since the price of gold is so high right now it really doesn't make sense to jump on the bandwagon now hoping that it will go even higher. |

|

Appreciate

0

|

| 11-02-2011, 12:26 PM | #18 |

|

Private First Class

11

Rep 151

Posts |

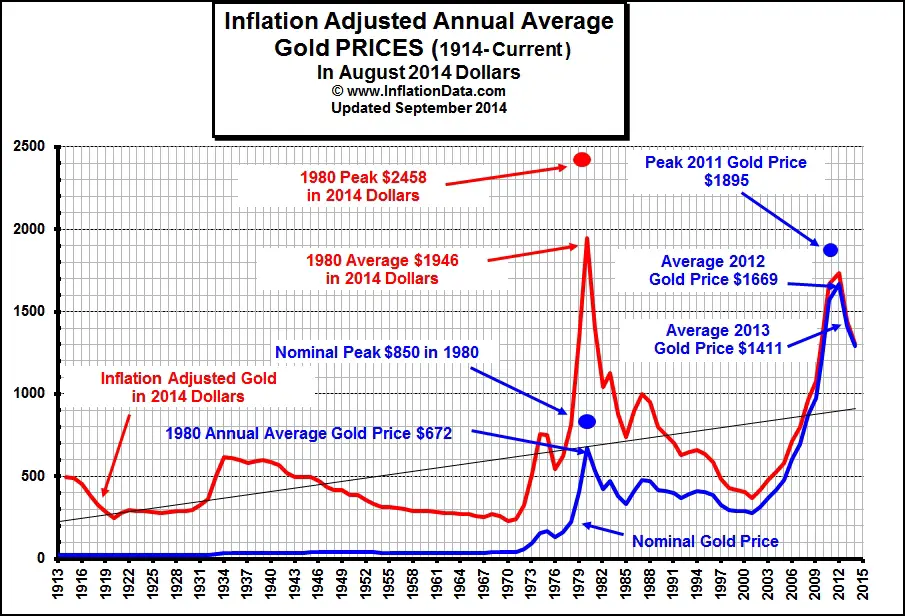

Just a quick reference on the price of gold adjusted for inflation:

I will agree that right now is not the BEST time to buy (I bought in late 2009). The other option is silver, it is a more volatile investment, but if timed right, you could make a significant profit. One thing to remember, there isn't enough physical silver IN THE WORLD to cover even a third of what is being traded on the COMEX. |

|

Appreciate

0

|

| 11-02-2011, 12:38 PM | #19 | |

|

Private First Class

11

Rep 151

Posts |

Quote:

I won't even compare silver as it has done far better than gold. |

|

|

Appreciate

0

|

| 11-02-2011, 01:19 PM | #21 |

|

Major

190

Rep 1,105

Posts |

I'm not sure how useful the inflation adjusted price chart is because gold is primarily useful as a hedge against inflation. Of course, when too many people hedge at once, the price skyrockets and the purpose is defeated.

It isn't exactly "real money", at least not at this time. It's a commodity. Don't believe me? Go down to the store and try to buy something with gold. There is some concern about the collapse of the dollar. I sort of agree- in that case, food and bullets will probably be more valuable than gold. I do keep about 40 oz of silver around though...just in case. My dad bought it in the 80's and just gave it to me when I was 10 and it lost 80% of it's value. Still got it. How exactly is more silver traded than there exists physical silver? How can I get into the business of selling silver that doesn't exist? Gold coins may not be as liquid as trading shares of a gold fund. There are a few problems with the fund though 1) How do you know the gold being traded actually exists, and you're not just trading worthless paper? 2) If the gold does exist, how do you know it's real? Gold bars are relatively easy to counterfeit. A Tungeston bar the same mass as a gold bar will have dimensions that are only off by .0017%. Make the bar a little undersized and coat it in 1/8" of real gold, and it is virtually indistinguishable from a real bar without drilling into it or melting it down. Nobody knows how much is out there. This is harder to do with coins. 3) If the SHTF, how are you going to get your hands on the actual gold you own shares of? At least with coins, you can roam the wasteland, shaving off little bits of a coin to trade with  |

|

Appreciate

0

|

|

| Bookmarks |

|

|